Let me clarify the confusion here. Until recently, the term WooCommerce payments has been used to refer to all payment service providers available for the WooCommerce platform. However, in May 2020, Automattic, the company behind WordPress and WooCommerce, launched their own payment plugin and named it WooCommerce Payments.

Yeah, at this point, you might ask, “Are you fuc*ing kidding me!?“.

I don’t know who is the genius behind this branding, but it reminds me of my odd childhood neighbor and his dog named Dog.

This post may contain affiliate links and I may earn a small commission when you click on the links at no additional costs to you.

So, in this article, I am ranting about WooCommerce Payments plugin, the real deal made by WooCommerce.

But before we go any further, let’s take a step back.

Probably you are entirely new in this eCommerce world, so let’s cover the basics. Otherwise, if you are experienced enough, you can skip this next section.

Table of Contents

What is WooCommerce?

WooCommerce is a free, open-source eCommerce builder. According to available data from statista.com, at the moment, WooCommerce is the most popular eCommerce builder with almost 30% market share.

WooCommerce itself actually is a WordPress plugin that adds a host of eCommerce features to any WordPress site.

Unlike other eCommerce builders, WooCommerce is entirely free to use. Although, to have a WooCommerce store, you must have a WordPress site. And to have a WordPress site, you’re going to need to pay a little bit for hosting and domain name. It’s possible to run a fully functional WooCommerce store for as little as $5 per month. If you are interested in building your own WooCommerce Store, read my easy step-by-step-guide How to set up a WooCommerce store fast.

What is WooCommerce Payments plugin?

New WooCommerce Payments plugin is Stripe´s powered online payment processor for WooCommerce platform. It is made by developers of WooCommerce, therefore fully integrated within its ecosystem. WooCommerce Payments is currently available to U.S.-based merchants only.

Started from WooCommerce version 4.1, WooCommerce payments plugin is integrated right into the welcome wizard, so every new WooCommerce store owner will see this as an option along with Stripe and PayPal.

In May 2020, Automattic, the company behind the WooCommerce, launched payment plugin named WooCommerce Payments.

Although at first glimpse, it looks like a brand-new payment processor made exclusively for WooCommerce stores. It is actually powered by Stripe.

I guess everyone agrees that payments are probably the most crucial part of eCommerce for both – shoppers and merchants. The first desires smooth checkout experiences, and the second crave simple and easy payments management interfaces.

Since its beginnings, WooCommerce has allowed merchants to choose from a range of third-party payment gateways, including Stripe and PayPal. However, to improve the merchant experience in managing payments, WooCommerce began building its native solution.

It’s a no-brainer, WooCommerce ambitions are clear here! If you are new online entrepreneur with low-risk business, you obviously will likely choose WooCommerce Payments plugin, because it’s made by WooCommerce and it is fully integrated with its ecosystem.

Read also: Let’s Get High Risk Merchant Account With Instant Approval

Main features of WooCommerce Payments plugin

For store owners WooCommerce Payments plugin enables an integrated payments dashboard to manage charges, deposits, and disputes directly from the WordPress / WooCommerce dashboard.

For the shoppers, on the other side, this payment solution offers easy and secure onsite payment, which theoretically reduces abandoned cart issues.

No more logging in to a separate payment processor’s website to track payouts or manage chargebacks. WooCommerce merchants can now manage their payments from their WooCommerce dashboard.

Paul Maiorana, General Manager of WooCommerce.

So to put it simply, the WooCommerce Payments plugin main features are:

• A payment gateway to accept credit and debit cards directly onsite.

• A dashboard for managing transactions, including payments, refunds, disputes, and deposits, integrated into your site’s WordPress administration area.

The only bummer about WooCommerce Payments plugin is, it is available for US merchants only. At least for now.

Pros and Cons of WooCommerce plugin

Pros:

- Excellent integration with WooCommerce store

- Powered by Stripe

- Payment gateway to accept credit and debit cards directly onsite

- Predictable flat-rate pricing.

Cons:

- Powered by Stripe (yes, it is also a con)

- Not suitable for high-risk industries

- Available only for US-based merchants

Requirements for WooCommerce Payments plugin

To successfully use WooCommerce Payments plugin you should have:

- United States-based business.

- PHP 7.0+;

- WordPress 5.3+;

- WooCommerce 4.0+;

- An SSL certificate to use the payment gateway in live mode.

According to WooCommerce documentation, WooCommerce Payments plugin is powered by Stripe. However, you have to connect to your Stripe account only once during the initial setup. After it is fully integrated with the WooCommerce platform and you can control payments directly in the WooCommerce back end.

How to Install WooCommerce Payments plugin?

For new WooCommerce Installation the system will prompt the WooCommerce Payments plugin installation when you set up your payment options.

If you already have a WooCommerce store installed:

- Download WooCommerce Payments app from the official WooCommerce site.

- Log in into your WordPress dashboard, go to “Add a new plugin” – Upload plugin, and choose this previously downloaded WooCommerce Payments plugin.

- Install it and after installation is done, activate it.

- You will see on the left side of the dashboard under WooCommerce tabs, there’s a new payment tab.

You still will have to set it up in order to accept payments.

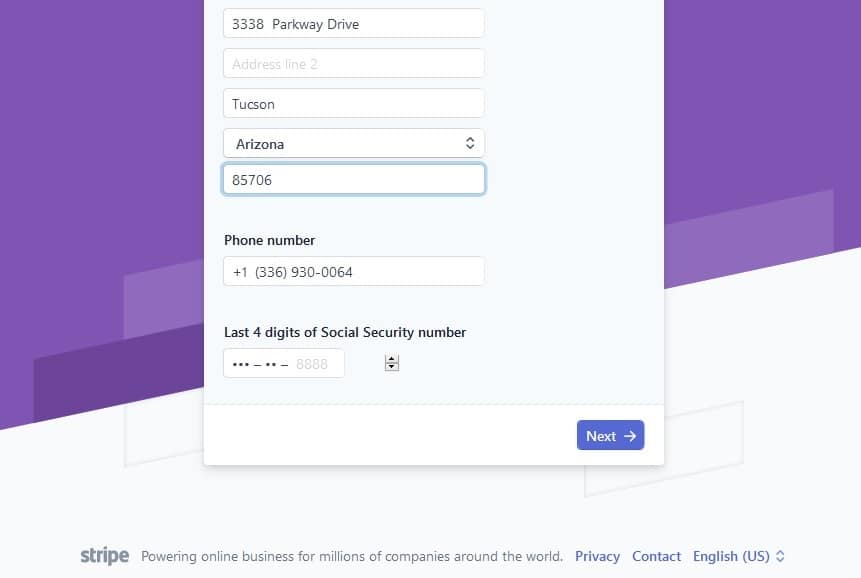

As part of the registration process, you’ll be asked to identify the type of entity, provide a phone number and e-mail.

At this point, they will send you a code via SMS, and you’ll have to enter the code to confirm the phone number.

Next, you’ll have to provide your name, address, and also your Social security number. So, I guess that’s the part where “only US-based merchants” apply.

After you will be asked to enter your site address and choose the business type. Finally, you will have to connect the plugin with your US bank account or debit card.

The entire process is pretty straightforward. It might take about five to ten minutes.

When it’s done you are ready to go! Full installation tutorial is also available on WooCommerce official support page.

With the first versions of plugin, you needed to install the Jetpack. Still, since plugin´s version 1.1 and newer, the Jetpack plugin is not required.

WooCommerce Payments plugin fees

WooCommerce Payments plugin uses a pay-as-you-go pricing model. The plugin is free to install, with no setup fees or monthly fees.Merchants have to pay only for activity on the account. The fees are:

2.9% + 30¢ per transaction for U.S. issued credit or debit card;

2.9% +1% for transactions paid using a card issued outside the U.S.;

$15 fee per dispute (refunded if you win the dispute)

For all WooCommerce Payments plugin users, WooCommerce has made its subscription service available for free!

This service is also available as an add-on for $199 a year to WooCommerce users who manage their payments with other payment gateways.

Along with subscription service, it allows recurring payments.

Previously for recurring payments, I have used Payolee. I still recommend this option to non-US merchants who can’t get WooCommerce payments.

Limitations of WooCommerce Payments plugin

Apart from being limited to the US and using US dollars, there are a few other limitations to be aware of, including compatibility with 3rd party applications and loss of historical data.

Compatibility with Apps

As I stated before, this payment processing solution is powered by Stripe. The great thing about Stripe is that it has a lot of infrastructures built directly on top of it. Lots of applications have a direct integration with Stripe. For example, you can sync payments with your accounting system.

With WooCommerce Payments plugin, you will have to do synchronization manually. If you use an application like Stripe Sigma or Billy Accounting Software, you would have to manually enter all of that data.

Cannot Import Historical Data

If you have a business for some time, there are lots of data accumulated about your customers. Some of it should be stored in WooCommerce, but some data is saved in the payment gateway (PayPal, Stripe, etc.). If you switch to WooCommerce Payments plugin, this data will be lost because you cannot import any historical data into this payment plugin.

Conclusion about WooCommerce Payments plugin

So far, WooCommerce payments plugin looks very promising and seems like a fantastic alternative to Stripe. Easy installation and complete integration in WooCommerce dashboard make it almost irresistible.

Although, before choosing WooCommerce payments plugin as your main payment plugin, you must remember, it is powered by Stripe, therefore WooCommerce Payments plugin has quite a long list of prohibited businesses.

On their webpage it is stated that following businesses and product types are not allowed to transact using WooCommerce Payments plugin:

- Virtual currency, including video game or virtual world credits

- Adult content and services

- Drug paraphernalia (including e-cigarette, vapes and nutraceuticals)

- Multi-level marketing

- Pseudo pharmaceuticals

- Social media activity, like Twitter followers, Facebook likes, YouTube views

- Substances designed to mimic illegal drugs

To see the full list, you have to visit Stripe’s Restricted Businesses list.

If your business is from the high-risk industries list, even do not consider it. There are other Payment options for High-risk businesses. To look further, read this Best High Risk Payment Processors For Startups in 2020 article.

On the flip side, if you are currently using Stripe or PayPal and if your business is considered low-risk, you should really consider to switch to WooCommerce Payments plugin.

There is really no point in having Stripe anymore if you can handle everything – the disputes, the transactions, and everything rest related to payments directly from your WooCommerce dashboard.